Investing can feel a lot like a rollercoaster—especially if you’re new to it.

When you’re surrounded by sensational headlines like “stock market tanks in one day” or “markets skyrocket after major announcement,” it can feel difficult to make rational financial decisions—and to know if you’re making the right ones.

It’s completely normal to have emotions surrounding investing—both “good” and “bad”. After all, it’s your hard-earned money we’re talking about, and putting it at risk can either feel catastrophic or euphoric. The trick is to temper your emotions with rational decision-making. Both can work together to pursue a positive outcome!

In this blog, we’ll explore why we tend to bring emotions into investing—and how it’s so common, researchers have found it often follows a predictable trend. We’ll also talk about how we can balance our gut feelings with wise strategies and sound advice.

How Do Emotions Play Into Investing?

Humans are emotional and rational creatures, and both emotions and logic play into decision-making. They just need to work together to do so. Here are a few ways emotions can show up in investment decisions:

- Emotions from one event can influence your decision-making skills regarding another event. This includes relational emotions (like frustration from arguing with a spouse) and global ones (like anxiety around a catastrophe that happened across the globe).

- Clickbait headlines can make emotions in investing more heightened. That’s what they’re designed to do—make you emotionally invested in the story so you click the link and read the article.

- “Good” emotions aren’t always good news for your investments. Increased confidence can actually make you take on more risk if you aren’t careful.

Our emotions are powerful—and it’s not wrong to have them when making investment decisions. However, it’s important that your emotions work for you, not against you.

Let’s explore what economists have discovered about investor emotions.

The Cycle of Investor Emotions

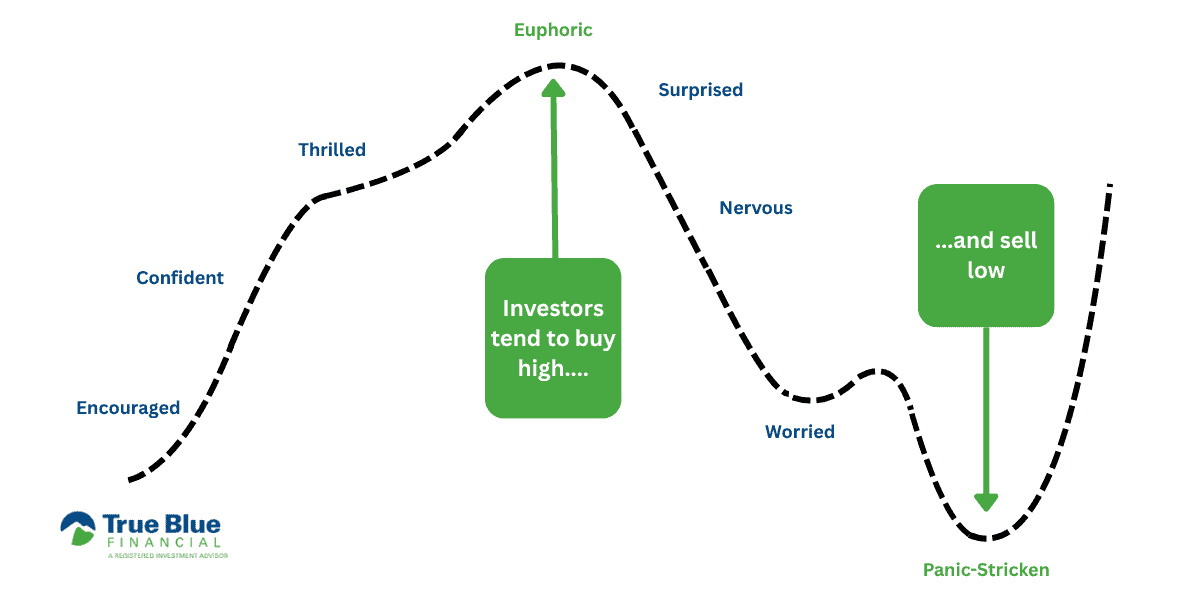

Emotions in investing are so common that they follow a cycle.

© 2022 BlackRock, Inc. All Rights Reserved. BLACKROCK is a trademark of BlackRock, Inc. All other trademarks are those of their respective owners.

Most investing starts with feeling encouraged—where we expect everything to go our way, especially if the market is looking good.

This typically crests into euphoria when markets reach the top of the cycle—this is where taking risks is especially…risky.

After the market starts to turn, emotions start to take a turn as well—from surprise, nervousness, to downright anxiety.

Panic is the very bottom of the cycle. However, sticking it out at this low point may have a greater chance of future returns.

These cycles happen often, and sometimes take years to complete. For example, consider the 2008 financial crisis. While the market hit absolute despondency in 2008 with the global recession, markets recovered slowly from 2009 to 2014, leading to confidence and euphoria from investors (and of course, the cycle repeated six years later with the COVID-19 pandemic of 2020.)

If you find that your emotions are tied up in your investments, you’re not alone! Let’s explore how to avoid complicated emotions in investing.

Addressing Common Investing Emotions

Fear of Loss

You’ve probably heard the adage that people feel a loss more than they feel again. Loss aversion is a well-known cognitive bias, so it’s normal if you feel this in your investments! However, acting on our tendency for loss aversion is not always a good call. This fear can lead to panic selling when your portfolio starts to dip instead of holding on for the long term.

How to address fear of loss: Understand that this bias is inherent in almost all humans—so having this gut reaction when you see red in your portfolio is normal. However, consider the loss in terms of your long-term strategy and talk to your financial advisor about the projected state of the markets and what their advice would be.

Greed

Most people wouldn’t describe themselves as “greedy,” but when investors try to make up for lost time and make a quick profit, they can become overly aggressive in their investing. Often the intent is good—they simply want to “catch up” on their portfolio because they feel behind.

How to address greed: Diversifying your portfolio can help you feel more secure in times of greed-driven speculation. (The cycle of investor emotions is also called the greed-fear cycle, where greedy investors buy at the highest level of financial risk.)

Anxiety

Anxiety is incredibly common in investing—news headlines on all of our screens certainly don’t help. Major global events almost always affect the markets, and media channels capitalize on this by generating sensational headlines for clicks and views. Anxiety can cause knee-jerk reactions in investors who feel tempted to “over-correct” their portfolio based on news reports.

How to address anxiety: It’s normal to get anxious about sensational headlines, but brush up on your media literacy. Sensational words describing the stock market as “plummeting,” “skyrocketing,” or “surging” are often misleading. Stay aware of the news, but always consider headlines within the perspective of your long-term strategy.

Also, consult a financial advisor you know before you trust anyone on an internet forum or social media platform. It’s better to receive advice from someone who knows your unique situation than someone who only wants engagement on their platform.

Overconfidence

Overconfidence in investing often comes from investors believing they can time the market. Timing the market is when an investor makes a purchase or trade in anticipation of price fluctuations. Investors often try to time the market when they think they’ve received “insider” or exclusive information. Attempting to time the market often leads to missing out on the market’s best days, which can significantly hinder long-term returns.

How to address overconfidence: Timing the market sounds like a great strategy in theory, but it often backfires. In fact, according to the S&P Dow Jones, fewer than 10% of investors, including professionals, beat the index. This is another good place to remind you that “insider” information on the internet is not always reliable and doesn’t have your best interest at heart. A trusted financial advisor can talk with you about current market trends and any adjustments your investment plan might need.

Fear of Missing Out (FOMO)

We have all gotten FOMO before—whether we missed out on an event or we think we’re missing out on capital gains from an investment! In our digital culture, FOMO in investing has become more prevalent as investment influencers generate buzz around certain investments. Investment influencers often prey on investors who want to “keep up with the Joneses” or avoid loss.

How to address fear of missing out: FOMO often leads to emotionally-driven investment decisions as opposed to rational, well-thought-out planning. When you see a tempting trend pop up on your newsfeed, send it to your financial advisor. They’ll be able to help you discern what is just a fad and what might be worth exploring.

Regret

Investing based on regret is often a result of being burned in the past or the fear of future regret (very similar to FOMO). An investor might over value a previous experience that they regretted, leading to indecisiveness and future missed opportunities.

How to address regret: Trust the process. Investing is an exercise in decision-making, and financial decisions never happen in a vacuum. Acknowledge past regrets and mistakes, then work with a trusted advisor to help you make more informed decisions.

Consider Long-Term Strategies

Financial advisors will always encourage you to think long-term instead of reacting to every market change. Most long-term strategies are effective no matter what your investment personality. Some of the most popular strategies include:

- Dollar-cost averaging: This is when you invest the same amount at regular intervals over a certain period of time. This can lower your average cost per share and reduce the impact of market volatility. Consistency is key in dollar-cost averaging.

- Diversification: Diversification is spreading your investments across diverse asset classes (not just stocks, but bonds, mutual and exchange traded funds, alternatives,, real estate, etc.) or across different market sectors. The main idea behind diversification is if you don’t have “all your eggs in one basket,” you’re less likely to feel as much market volatility.

Developing and sticking to a long-term strategy can feel risky at first, especially when you watch the market take a dip. But keeping a long-term view can benefit you in the long run! Take a look at the graph below. It shows the rising and falling of the market over a 125-year period. Regardless of significant dips (including the Great Depression and the 2008 recession, which you can clearly see,) stocks typically rise over the long term.

Professional Advice Can Help You Keep a Level Head

Emotions in investing are inevitable. But when you have a long-term strategy and set clear goals, you can temper your emotions with wisdom. A financial advisor can help you with this! When you have a professional who can offer knowledgeable advice and hold you accountable, you’re much less likely to make hasty decisions based on emotions.

If you currently don’t have a financial advisor, True Blue Financial is here to help! We offer comprehensive, client first advice that helps you set the right goals and develop a strategy. Schedule a complimentary call with our team today to find out more!